In addition, to use the optional computation of tax, the total gross self-employment income must be subject to withholding at source or to estimated tax payments and must be reported in an Informative Return. For these purposes, accrued income will be considered to come substantially from services rendered when said income category represents at least 80% of the total gross income received during the taxable year. The income received must be substantially from the provision of services. In excess of 400,000 but not more than 500,000 In excess of 300,000 but not more than 400,000 In excess of 200,000 but not more than 300,000 In excess of 100,000 but not more than 200,000

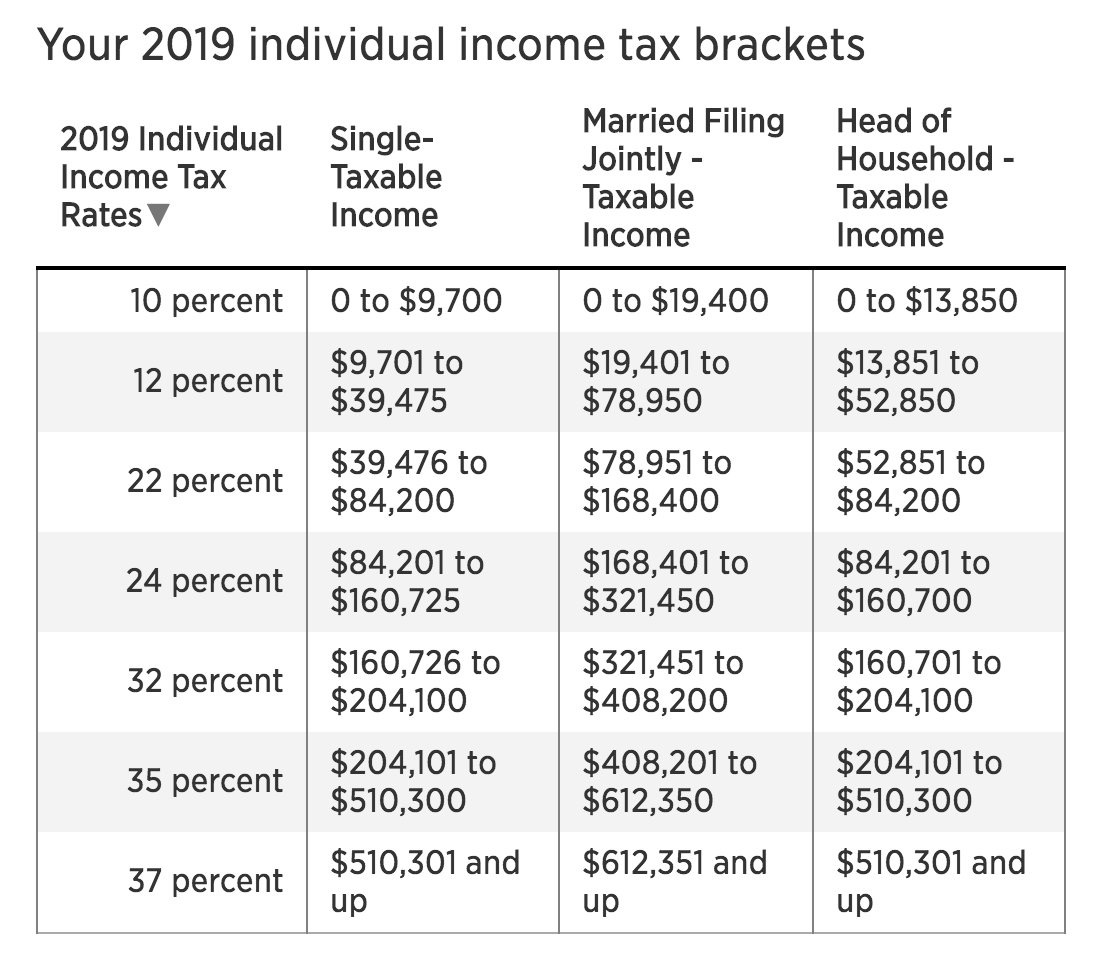

#US INCOME BRACKETS CODE#

Self-employed individuals whose income is derived substantially from the business of rendering services may elect to pay an optional tax on gross income instead of the income tax otherwise imposed by the Code on net income, as follows: Gross income (USD) New optional tax for self-employed individuals rendering services If gross income is USD 100,000 or less, then the individuals total tax will be 92% of one's total tax determined.

#US INCOME BRACKETS PLUS#

The ABT will not be applicable to individuals whose only source of income is from salaries informed in a Withholding Statement.įor tax years after 31 December 2019, an individual's total tax will be 95% of one's total tax determined (regular tax plus gradual adjustment) if gross income exceeds USD 100,000. When determining the net income subject to ABT, this credit will be reduced by the portion of the ABT attributable to non-deductible expenses.

The credit for prior years’ ABT liability may not be sold, transferred, or refunded. In excess of 150,000 but not more than 250,000 In excess of 75,000 but not more than 150,000 In excess of 50,000 but not more than 75,000 In excess of 25,000 but not more than 50,000 ABT rates: Net income subject to ABT (USD) The ABT taxable income is computed by adding back certain income items exempt from regular income tax. In addition to the regular income tax, individuals are required to compute an ABT assessed in accordance to the below tax table. This tax is 5% of the excess of the total net taxable income over USD 500,000, limited to 33% of their personal and dependents' exemption plus USD 8,895. If the individual's net taxable income exceeds USD 500,000, they will have to pay an additional tax (i.e. USD 8,430 plus 33% of the excess over USD 61,500 USD 3,430 plus 25% of the excess over USD 41,500

USD 1,120 plus 14% of the excess over USD 25,000 The following regular tax rates remain in effect for 2018 and future years: Net taxable income (USD) Income from personal services performed within Puerto Rico will not be considered from Puerto Rican sources if it is 3,000 United States dollars (USD) or less and the individual was present in Puerto Rico for 90 days or less during the calendar year (such personal services must have been provided to an employer who is not engaged in a trade or business in Puerto Rico). Puerto Rico has a de minimis rule to avoid sourcing to Puerto Rico very small amounts of income from personal services. Such income is typically prorated to Puerto Rico based on workdays. Income for services performed is sourced to Puerto Rico based on where the services are performed. Puerto Rican non-residents are only taxed in Puerto Rico on their Puerto Rico-source income. Puerto Rican residents are taxed in Puerto Rico on their worldwide income, no matter where the income is sourced.

0 kommentar(er)

0 kommentar(er)